Navigating the world of financing can often feel daunting, especially for aspiring entrepreneurs seeking a Startup Business Loan with no initial capital. However, understanding the various types of loans available and preparing a solid business plan significantly enhances your chances of securing funding. By improving your credit score and exploring alternative funding options, you can better position yourself when approaching lenders. In this guide, we will explore practical steps to help you unlock the financial support needed to bring your startup vision to life.

Understanding Startup Business Loans

A Startup Business Loan is essential for entrepreneurs looking to launch their new ventures without upfront funds. These loans provide the necessary financial support to cover initial expenses, such as:

- Equipment purchase

- Inventory acquisition

- Marketing costs

- Operational expenses

To make informed decisions, it’s crucial to understand the different aspects of Startup Business Loans:

- Qualifications: Typically, lenders require a strong business plan, credit history, and sometimes collateral.

- Repayment terms: These loans come with various repayment options, ranging from short-term (1-3 years) to long-term (up to 10 years).

- Interest rates: Rates can vary widely, depending on the lender and your credit profile.

In summary, a Startup Business Loan can be a lifeline for budding entrepreneurs, enabling them to turn their innovative ideas into reality. Recognizing the requirements and benefits of these loans is the first step towards securing the funding you need.

Types of Loans Available for Startups

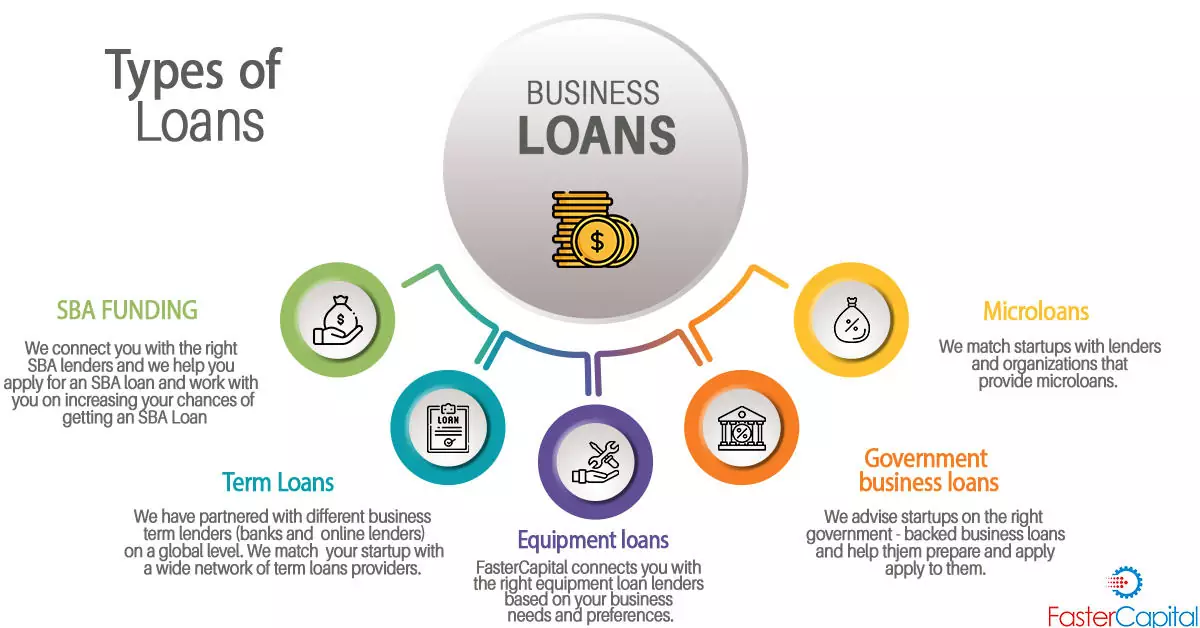

When seeking a Startup Business Loan, it’s crucial to understand the various loan types available for startup companies. Each option comes with distinct features, repayment terms, and eligibility criteria. Here’s an overview of popular startup loan types:

- SBA Loans: Guaranteed by the Small Business Administration, these loans offer favorable terms but require thorough documentation.

- Pros: Lower interest rates, longer repayment periods.

- Cons: Lengthy application process.

- Term Loans: These loans provide a lump sum that you repay over a set period, often with fixed interest.

- Pros: Predictable payments.

- Cons: Requires good credit history.

- Line of Credit: This flexible option allows you to borrow up to a limit whenever you need it.

- Pros: Only pay interest on the amount used.

- Cons: Variable interest rates can increase costs.

- Microloans: Smaller loans aimed at startups needing limited funding, often provided by non-profit organizations.

- Pros: Easier approval processes.

- Cons: Lower maximum amounts.

When selecting a Startup Business Loan, evaluate your needs, financial situation, and the loan’s terms. This careful consideration will help you choose the best financing option for your startup.

Building a Solid Business Plan

Creating a strong business plan is crucial when seeking a Startup Business Loan. A well-crafted plan not only outlines your business strategy but also demonstrates your commitment and vision to potential lenders. Here’s how to build an effective business plan:

- Executive Summary: Summarize your business concept, including the mission, vision, and goals.

- Market Analysis: Research your industry and target market. Provide data on market size, trends, and competitors.

- Business Structure: Clearly define your business model and organizational structure.

- Marketing Strategy: Outline how you plan to acquire and retain customers. Detail your pricing, sales, and promotional strategies.

- Financial Projections: Include realistic forecasts for revenue, expenses, and cash flow. Highlight how the Startup Business Loan will be utilized to achieve financial growth.

- Appendices: Attach supporting documents, such as resumes, legal agreements, and additional data.

By presenting a clear, comprehensive business plan, you enhance your chances of receiving a Startup Business Loan and showcase your readiness to succeed.

Improving Your Credit Score

A strong credit score plays a crucial role in securing a startup business loan. Lenders often assess your creditworthiness, so improving your score enhances your chances of approval. Here are effective strategies to boost your credit score:

- Check Your Credit Report: Regularly review your credit report for inaccuracies. Fixing errors can significantly increase your score.

- Pay Your Bills on Time: Consistently paying bills such as utilities and credit cards boosts your payment history, which constitutes 35% of your credit score.

- Reduce Your Debt: Aim to lower your credit utilization ratio below 30%. This ratio compares your total debt to your total credit limit.

- Limit New Credit Applications: Each hard inquiry can temporarily lower your score. Be cautious with new credit applications, especially before seeking a startup business loan.

- Use a Mix of Credit Types: Having different types of credit accounts (e.g., installment loans and revolving credit) can positively impact your score.

By focusing on these strategies, you’ll position yourself as a more appealing candidate for a startup business loan, thus opening doors to potential funding.

Alternative Funding Options

When traditional financing seems out of reach, explore these alternative funding options to secure the necessary capital for your startup business loan:

- Crowdfunding

Leverage platforms like Kickstarter or Indiegogo to gather support from individuals who believe in your vision. Offer rewards or equity in return for their contributions. - Angel Investors

Seek out wealthy individuals willing to invest in your business in exchange for equity. These investors not only provide funds but can also offer valuable mentorship. - Venture Capital

If your startup demonstrates high growth potential, consider approaching a venture capital firm. In exchange for significant funding, expect to give up a portion of ownership. - Grants

Research local and national grants available for startups. Unlike loans, grants do not require repayment, which can be a great boost to your startup business loan strategy. - Peer-to-Peer Lending

Platforms like Prosper or LendingClub connect borrowers directly with lenders. You may find more flexible terms compared to traditional banks.

By diversifying your funding sources, you’ll enhance your chances of securing the ideal startup business loan for your venture.

Tips for Approach Lenders

Approaching lenders for a Startup Business Loan can be daunting, but with the right strategies, you can make a lasting impression. Here are some effective tips to help you navigate the process:

- Be Prepared: Gather all necessary documents, including your business plan, financial projections, and personal financial statements. Lenders want to see that you have a solid strategy.

- Know Your Numbers: Understand your business’s financials and be ready to discuss them. This includes revenue forecasts, profit margins, and cash flow projections.

- Tailor Your Pitch: Customize your approach to each lender. Research their loan offerings and align your presentation with their requirements.

- Practice Your Pitch: Rehearse explaining why you need a Startup Business Loan and how it will benefit your business. Confidence and clarity can significantly influence lender perception.

- Be Honest and Transparent: Share your business’s strengths as well as the challenges. Being straightforward establishes trust.

- Follow Up: After your initial meeting, send a thank-you note and follow up with any additional information requested. This demonstrates your commitment and professionalism.

By applying these tips, you’ll enhance your chances of securing a Startup Business Loan successfully.